You plan on getting an MBA from a top business school such as Harvard in the US, INSEAD in Europe, or ISB in India.

You are fairly confident of cracking the GMAT, and you feel that your profile is good enough to get you to that final interview.

However, there is one thing that remains in the back of your mind every time you think about and MBA – How to finance your MBA.

You have probably read that a two-year MBA can cost upwards of a crore, especially if you plan on doing it abroad.

That’s 10000000!

Heck! You can’t even count the zeros without putting your finger below the text.

Considering the cost of a full-time MBA, you might think of an Executive MBA or an online MBA degree. But we know that your heart is set on getting an MBA from one of the top colleges in another country.

Worry not!

There are 6 ways in which you can finance your International MBA:

- A loan from an Indian Bank against existing collateral such as property

- A non-collateral loan either from banks or other financial institutions

- A non-cosigner loan provided by top 10 schools in the US

- A loan from a US bank where you have a US citizen acting as your guarantor

- Soft loans from friends and family & liquidating assets & investments

- Scholarships, and other financial aids offered by colleges.

Let us look at each one in detail (alternatively, you can directly jump to the parts you are interested in knowing about)

1. Finance your MBA through Collateral Education Loans

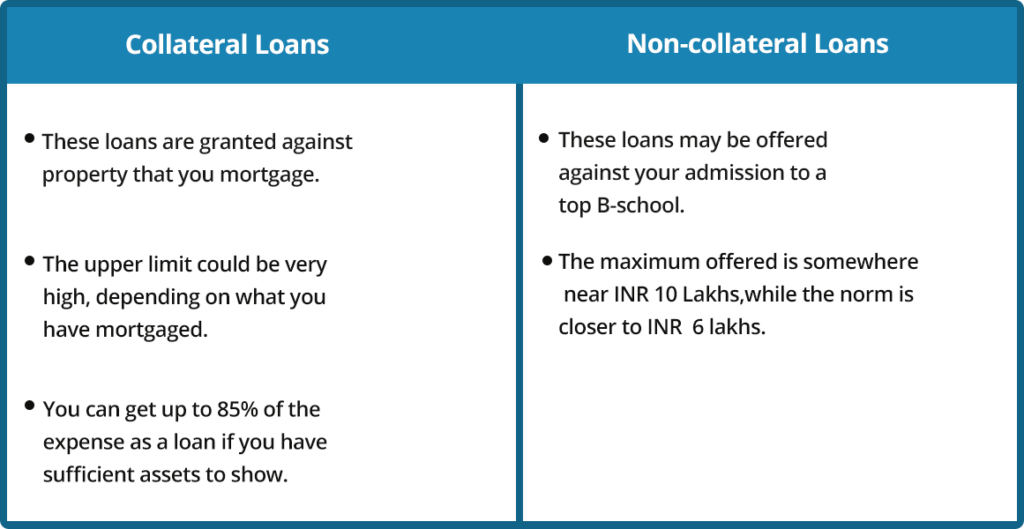

Let us understand what the term “collateral loans” means.

Collateral-based education loans are loans in which the bank will take some form of a “guarantee”. If your parents have any kind of assets such as house, property or some long-term investments then you can use such things to get a loan from the bank. Alternatively, banks are also willing to provide loans against security such as Fixed Deposits (FD), Provident Funds (PF), and government bonds.

Many students are worried about taking such a loan because they feel they will inconvenience their parents. However, you are doing so only to get the loan sanctioned – once you graduate, you should plan on repaying this loan. Also, banks won’t repossess assets unless they are absolutely sure there is no other way for them to recover their dues.

Typically the loan amount would be a percentage of the asset value. Let us say you are able to show a property worth Rs.1 Cr then you may get loans up to Rs.60-70 lakhs against it.

Usually having a favorable relationship with the Bank branch manager would help to expedite the process as loans are still seen as a “risk” by the banks. However, you should check the interest rates from various banks before you make this decision.

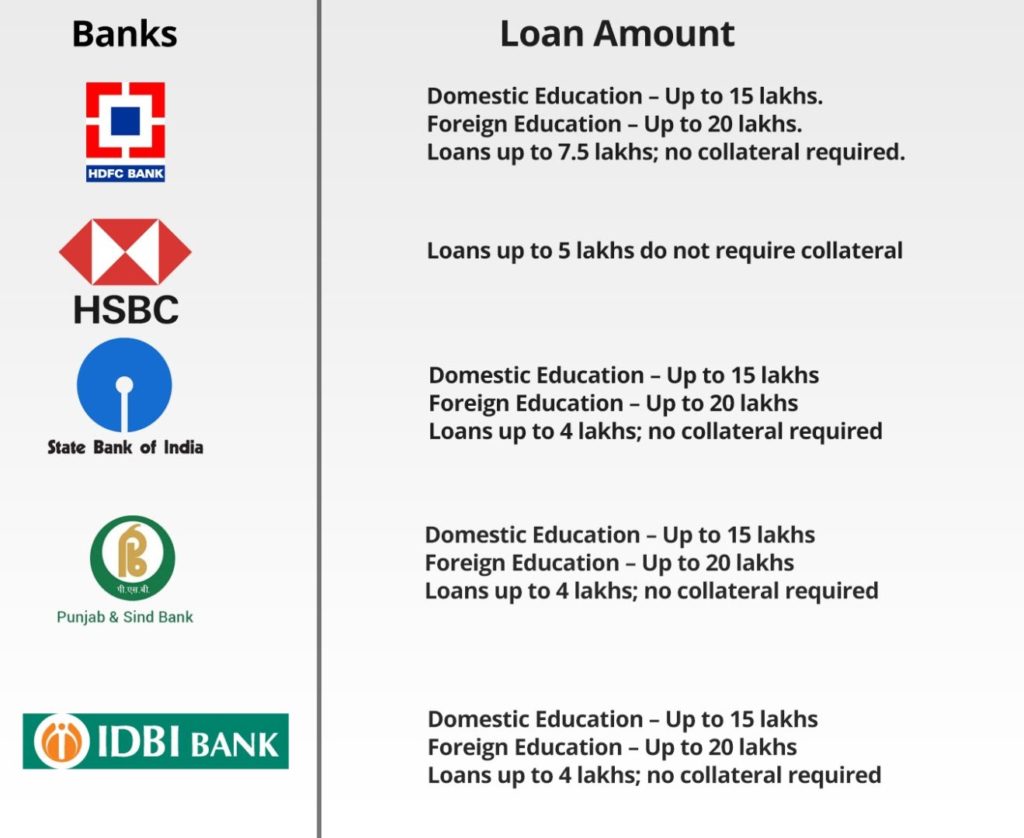

Here is a list of some of the top banks in India where students routinely go for educational loans:

2. Non-Collateral Education Loans to Fund your MBA

So what are “non-collateral” education loans?

Non-collateral education loans are loans where you don’t have to offer to show any property or asset to avail of the loan.

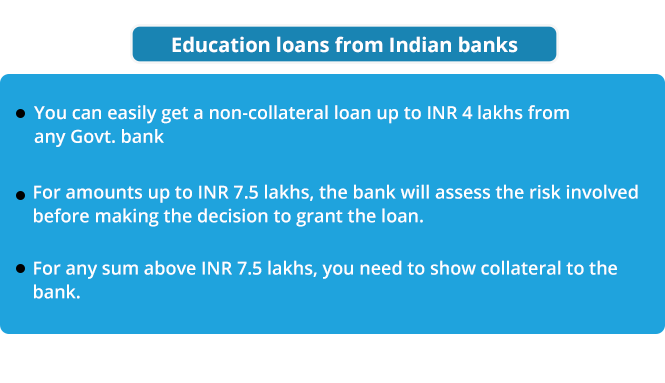

Most of the banks in India would offer non-collateral loans however the total amount they might be willing to provide is very low.

In general, while looking at education loans from Indians banks remember the following:

So, what is the difference between education loans that require you to keep some kind of collateral as a guarantee and education loans that don’t need any such collateral?

Made it to ISB? Then check out the list of banks in India where you would get a non-collateral loan.

But wait – it is not just banks but there are many non-banking institutions that provide unsecured loans (loans without pledging collateral) that amount to more than 7.5 lakhs.

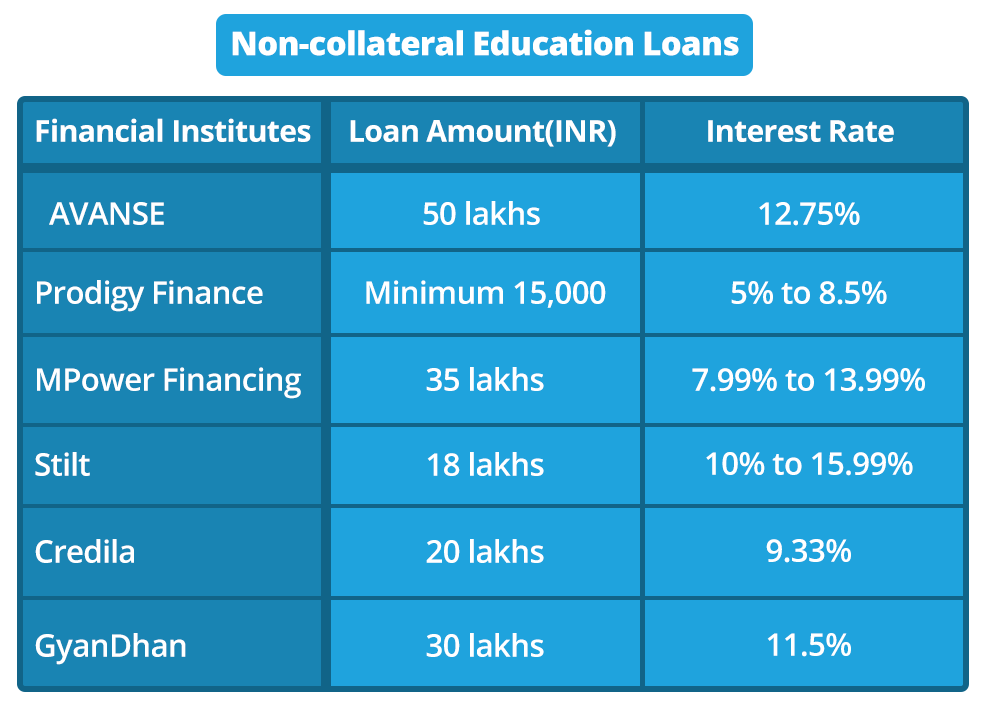

So, what are the companies providing non-collateral educational loans for finance your MBA?

There are companies including financial service providers and loan providing companies such as Avanse, Prodigy Finance, Stilt, Gyandhan, mPower, and Credila who provide educational loans.

The reason they are able to operate without providing any collateral is that many of these “fintech” companies have sophisticated algorithms to predict your ability to pay back the loan.

The factors that impact your loan rate would typically be:

The ranking of the college you get into

The prospects for your specific field

Your previous employment history

Such algorithms “predict” the chance of success but as it is a higher value loan without collateral, there is a risk involved. Therefore, they charge a higher rate of interest when compared to the collateral loans you get from banks. In most cases, they might also require a co-applicant or co-signer for the loan to be sanctioned.

Here is a snapshot of the loans provided by such companies:

The amount that a student can borrow varies, depending on the B-School and the cost of tuition for the program.

3. Education Loans to finance your MBA through a co-signer in the US

Looking at doing an MBA in the US?

Have a close relative who is a US citizen and can act as a guarantor?

If the answer to both the questions above is a yes then the co-signer option is something you must explore.

Co-signing mainly involves getting someone who’s been in the U.S. for a while to sign the loan contract with you.

Yes! You are still liable to pay the debt after you graduate, but if you fail to pay off the debt after you graduate, your co-signer comes into the picture.

With the co-signer option, the bank reduces its risk by having an opportunity to recover its money from the co-signer (bad news for the co-signer!).

Being a co-signer comes with some risk, and that’s the reason co-signers are often skeptical about it as their credit ranking would be in jeopardy. So make sure you have an honest conversation before proceeding with this option.

Wells Fargo and Citizens Bank are two institutions that provide loans to international students with a US co-signer.

Other institutions include Sallie Mae, Union Federal, and Discover.

4. Education Loans to finance your MBA without collateral or co-signer

We have a lot of our students asking us:

How can I get an education loan without parents?

Can I get a student loan without collateral?

The answer is Yes!

There are a good number of US B-schools offering student loans without a U.S. co-signer. This means that the B-school itself will stand as your guarantor.

Currently, the following US schools provide collateral-free loans to Indian students:

1. Harvard Business School

2. Stanford Global School Of Business

3. Wharton School of the University of Pennsylvania

4. Cornell University

5. Duke Fuqua School of Business

6. Haas School of Business

7. Yale School of Management (SOM)

8. The Darden School of Business

9. UCLA Anderson

10. Kenan-Flagler Business School

11. MIT Sloan

So that means once you get your admission, typically the college will help facilitate the entire transaction. The collateral that is on offer is really the reputation of your degree!

Each of these colleges provides Private Student Loans and other financial aids for MBA to international students depending on the applicant’s financial status, profile and ability to pay back the loans. You can get more information on the school’s website.

Interested to know more about non-cosigner loans? See our detailed blog on Non-cosigner Student loans given by Top MBA Colleges for International students.

5. Self-financing your MBA

If you want to pursue an MBA abroad, then you’re aware that most B-schools require that you have 5 or more years of work experience.

Self-finance basically means basically scraping the bottom of the barrel to ensure your loan amount is as low as possible.

A question that people frequently ask is – shouldn’t we stay invested? However, we are of the opinion that it is better to save the definite 12% (say) interest than to gain a potential 15% return. Having said so, you are the best judge.

Here are some places you could look into:

a) F-F-F:

Someone humorously quipped you can always ask for a loan from “Friends – Family and Fools”!

This basically entails discussing your MBA plans with a trusted friend or a family member (this could also be your favorite uncle or aunt who lives abroad) and asking a loan for a couple of years with a promise to repay them back. The person you can borrow from is someone with whom you are comfortable with and who you can peacefully payback after you start earning.

One thing to note here is that your personal relationship with that person could be at stake so make sure you set proper expectations before you get into such an agreement.

b) Savings

You’re looking at all the money you have invested in other places, such as bonds or fixed deposits. This is not the time to “time” the market (is there really such a thing as “timing the market?” – it’s a separate conversation!).

So all the SIPs you have invested over the years (except the ones through ELSS as it may have a longer tenure for tax saving). Once any of your investments mature you can take it out instead of reinvesting.

Most people don’t consider PF and Gratuity – but you would be surprised to see the amount that gets accumulated over a few years.

c) Deposits / Sales of Assets

Got a car or a bike? Sell it!

Paid an upfront deposit for your apartment? Get it back!

Have furniture and nicknacks collected over the years? Sell it online.

Get the drift?

The point is also you need to be starting “afresh” – almost in a metaphysical way. So better to let go of a lot of things in a Marie Kondo kind of way. The idea is you want your MBA to start on a clean slate – especially if you are going to go abroad.

6. Scholarships

That is only partly joking! 🙂

Remember that most of the options we have cited above involve taking a loan. That means once you graduate, a significant portion of your salary will go towards serving your educational loan.

In some cases, such loans can run into years, and may severely impact your professional decisions – such as starting up on your own. The best deal is when you get to do an MBA without having to pay the full fee for it.

However, the first lesson they teach you in a B-school is “there are no free lunches”. This means nobody is going to give you anything without expecting anything in return. So why do B-schools offer an MBA scholarship?

The reason they offer a scholarship because they want the smartest students in the class. And once you have gotten admission the only thing that is going to help them make an objective decision is the objective data-point they have in their hands: your GMAT score!

The scholarships are generally classified into:

- Need-based scholarships – given after considering your financial background, including various assets and liabilities.

- Merit-based scholarships – offered based on your GMAT score and profile.

However, colleges now provide scholarships based on both merit and need for current students.

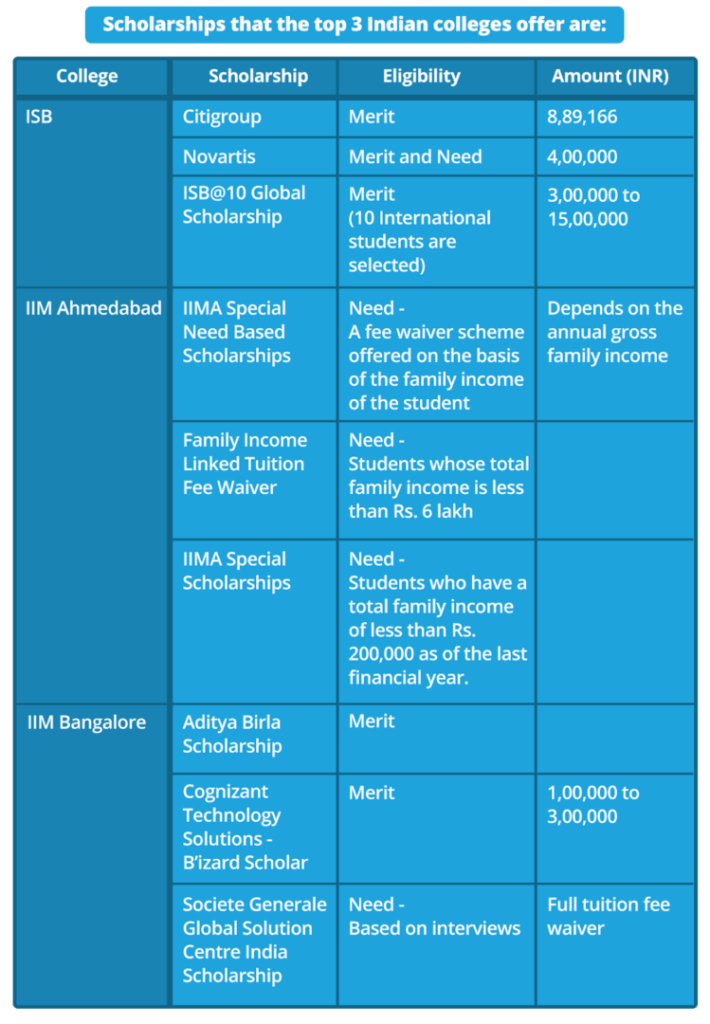

Some of the scholarships that the top 3 Indian colleges offer are:

Here is a list of a few of the International scholarships provided by various organizations. You can find more information on their websites:

Prodigy Finance Scholarship – International students applying to a college that Prodigy Finance supports are eligible for this scholarship. The recipient is chosen based on an internal assessment and public voting. The assessment criteria is merit-based, skill-based and an essay on why you deserve the scholarship and how it will impact your post-grad experience.

J.N. TATA Scholarship – This loan scholarship ranges between INR 1,00,000 and 10,00,000 for full-time Postgraduate/Ph.D./Postdoctoral studies/Research Fellowships abroad in all fields.

British Council – The British Council has launched the GREAT scholarships campaign in collaboration with UK’s GREAT campaign for a range of subjects. Universities accepting these scholarships include Imperial College London, Newcastle University, University of Kent, etc.

Stanford Reliance Dhirubhai Fellowship – This scholarship is only for Indian students, the Stanford Reliance Dhirubhai fellow will receive financial support for approximately 80% of the cost of tuition and associated fees for a single student each year of the two-year Stanford MBA Program. However, students are required to return to India within 2 years of completing their degree and must work for an Indian organization.

Just putting it out there—a scholarship WILL NOT solve all your financial woes.

Very rarely do you get full-paid scholarships, and even if you’re a lucky one who does, these full-paid scholarships will probably only cover tuition costs and living expenses, but any other expenses you might have as a college student is not covered by scholarships.

The most common MBA scholarships will cover only a percentage of the tuition fees, but that doesn’t mean you should give up on getting a scholarship. You should still do all you can to get a scholarship as it will lighten your burden.

You can find out more information on scholarships and other financial aids by talking to one of Crackverbal’s mentors. We will be able to help you with your entire application process and we offer coaching classes for those looking to do their GMAT and other competitive exams.

Recommended Read:

All you need to know about MBA scholarships offered by Top-B- Schools in 2020

How I got into Rotman MBA program with a $15,000 Scholarship!

‘How Mansha Sharma got 3 admits to Top US b-schools with an 80% scholarship

How Priyadarshini got into ISB, Schulich, HEC Montreal & WP Carey (100% Scholarship)

How Rashmi got into University of Arizona for MIS with 100% Scholarship!

If you found our article useful, share it with your friends who are looking to pursue their executive MBA or Masters abroad (or for that matter in India.)

If you have any questions, feel free to comment; we’ll be glad to help you.

Wondering which top B-School you can get into this year? Let us help you!